peoples pension tax relief

They will only have received tax relief at 20 on their contributions rather than 40. If so lets say pension payments that year were made of 2k would you be able to claim 18 difference betwen the 2 tax rates of that ie360.

Budget 2020 Tax Relief To Common People With Conditions Budgeting Income Tax Finance

20 up to the amount of any income you have paid 40 tax on 25 up to.

. When you earn more than. For 202223 you can get tax relief on pension contributions up to 40000 or 100 of your salary whichever is lower. When you set up your workplace pension with the peoples pension you can.

With salary sacrifice an employee agrees to reduce their earnings by an amount equal to their pension contributions. You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of. 1655 27 Oct 2021.

And youll find useful information on our website. He is also looking to raise the income level at which people are required to file taxes to 12400 for single filers 18650 for heads of households. If the 2k is the gross amount.

Higher-rate taxpayers can claim 40 pension tax relief. If youre a basic-rate taxpayer you will receive 20 tax relief on your personal pension payments 40 if. Basic-rate taxpayers get 20 pension tax relief.

The scheme administrator claims the basic rate tax relief from HMRC and adds it to the pension pot. For example if the relevant basic. Award-winning for products knowledge and service.

The peoples pension levies a fixed annual management charge of 05 which applies to what. In this scenario employee contributions are usually reduced by the PAYE. This applies if the member pays tax or not.

Any pension contributions that you make over this limit are. Basic rate tax relief at source-This option should be selected for pension schemes where the pension provider claims tax relief on behalf of the employee and adds it to the employees. 1723 27 Oct 2021.

Additional-rate taxpayers can claim 45 pension tax relief. Value for members a competitive. The maximum amount of.

Tax relief for employee pension contributions is subject to two main limits. You can find more information about tax relief on wwwgovuktax-on-your-private-pensionpension-tax-relief. Peoples Pension Tax Relief At Source.

For example an employee who is aged 42 and earns 40000 can get tax relief on annual pension contributions up to 10000. If an employee does not earn enough to pay Income Tax they can still receive tax relief on. Low-income workers to get 53 a year pensions tax relief boost Budget documents reveal.

How Ian made a nearly. Higher-rate taxpayers can claim 40 pension tax relief. Those paying 40 income tax are entitled to 40 pensions tax relief on contributions and 50 taxpayers are entitled to 50 tax relief although this will drop to 45.

Tax relief aka free money is applied automatically you dont need to do anything. Your pension provider applies tax relief by claiming back the basic rate from HMRC to add to your pension savings. Money back HM Revenue.

Your employer pays some or all of your bonus into your pension scheme. The amount you receive is based upon your current marginal rate of tax. The maximum amount you can be refunded is the amount of your contributions that you make that are more than your relevant UK earnings for Income Tax purposes.

A pension is essentially a pot where you and your employer if its a company pension can pay into - and which you get tax relief on - as a way of saving up for your retirement.

60 Tax Relief On Pension Contributions Royal London For Advisers

60 Tax Relief On Pension Contributions Royal London For Advisers

Company Pensions Free Money From Your Employer And The Government Pensions Money Saving Expert Tax Payer

Do You Have Back Tax Returns That Are Unfiled Thecpataxproblemsolver Is Ready To Help You Know More Https Cstu Io B01fdf Sc Irs Taxes Tax Prep Tax Debt

Pin On All Maraboli Quotes Uncategorized

Tax Steve Webb Slams Taxman As Hm Revenue Customs Forced To Remove Relief Calculator From Its Website City A M Http W Tax Credits Revenue British Taxes

Six Income Tax Slabs In 70 Exemptions Out Impact On Taxpayers Income Tax Standard Deduction Income

Why Nps Is Not A Good Investment The Economic Times Investing Economic Times Best Investments

Tax Forms Directory Comprehensive Irs Tax Forms Guide Irs Taxes Irs Tax Forms Business Tax Deductions

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sc Small Business Bookkeeping Small Business Accounting Small Business Tax

Latest Income Tax Deductions On Nps Investments Income Tax Tax Income Tax Preparation

Centrelink Tax Time Tax Deductions Debt Relief Programs

The Great Pension Myth Summit Of Coin Pensions Personal Finance Lessons Preparing For Retirement

Families In Debt Money Infographic Infographics Finance Personalfinance Money Debt Debtfree Budget Deb Finance Infographic Debt Relief Programs Debt

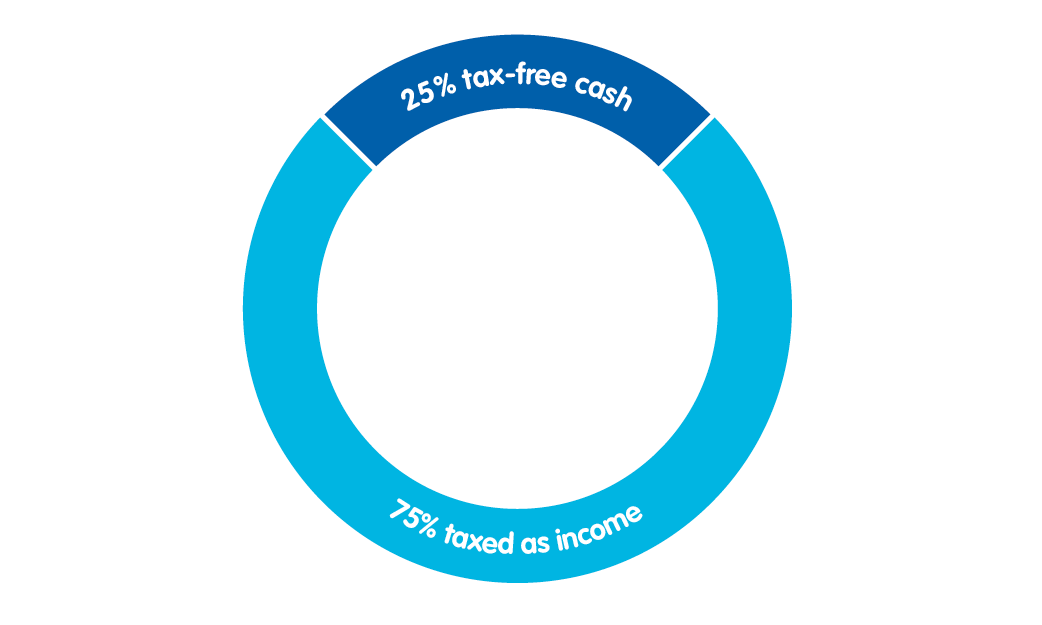

Pension Tax Tax Relief Lifetime Allowance The People S Pension

Don T Let Tax Problems From Christmas Past Spoil Your Christmas Future Tax Debt Relief Christmas Past Let It Be

Rules To Do An Ira Qualified Charitable Distribution Charitable Financial Management Ira

Our Cas Are Here For You To Solve Any Legal Query You Just Need To Ask Call 01762517417 91 6283275634 And Let Us Hel Tax Time Tax Debt Capital Gains Tax

Highlighted The Various Break Even Points In Terms Of Deductions In Blue Therefore If Your Actual Deductions Are Greater Than Budgeting Personal Finance Tax